Consumer lending

Changing lending for the better

Responsible Consumer lending

We’ve been lending since 2014 and have developed into one of the leading non-bank loan providers in the UK. Our consumer loan products cover the widest customer spectrum of any lender in the UK, with loan amounts ranging from £500 to £15,000 across Prime, Near Prime and Non Prime APR bands.

Our products are designed with flexibility, simplicity, and great customer experiences in mind and are underpinned by the proprietary technology and analytics capability within our O6K platform.

Aligning to our Purpose of ‘simplifying and personalising borrowing’ and delivering our Vision of ‘changing lending for the better’, we’re creating products and services designed to help improve the financial wellbeing of our customers.

As a digital lender, customers can apply for our products on any internet enabled device and get a personalised offer within minutes, underpinned by rigorous affordability assessments to ensure the highest standards of responsible lending. Customers are able to manage their loan by accessing their online account, email, SMS, Webchat or by calling us.

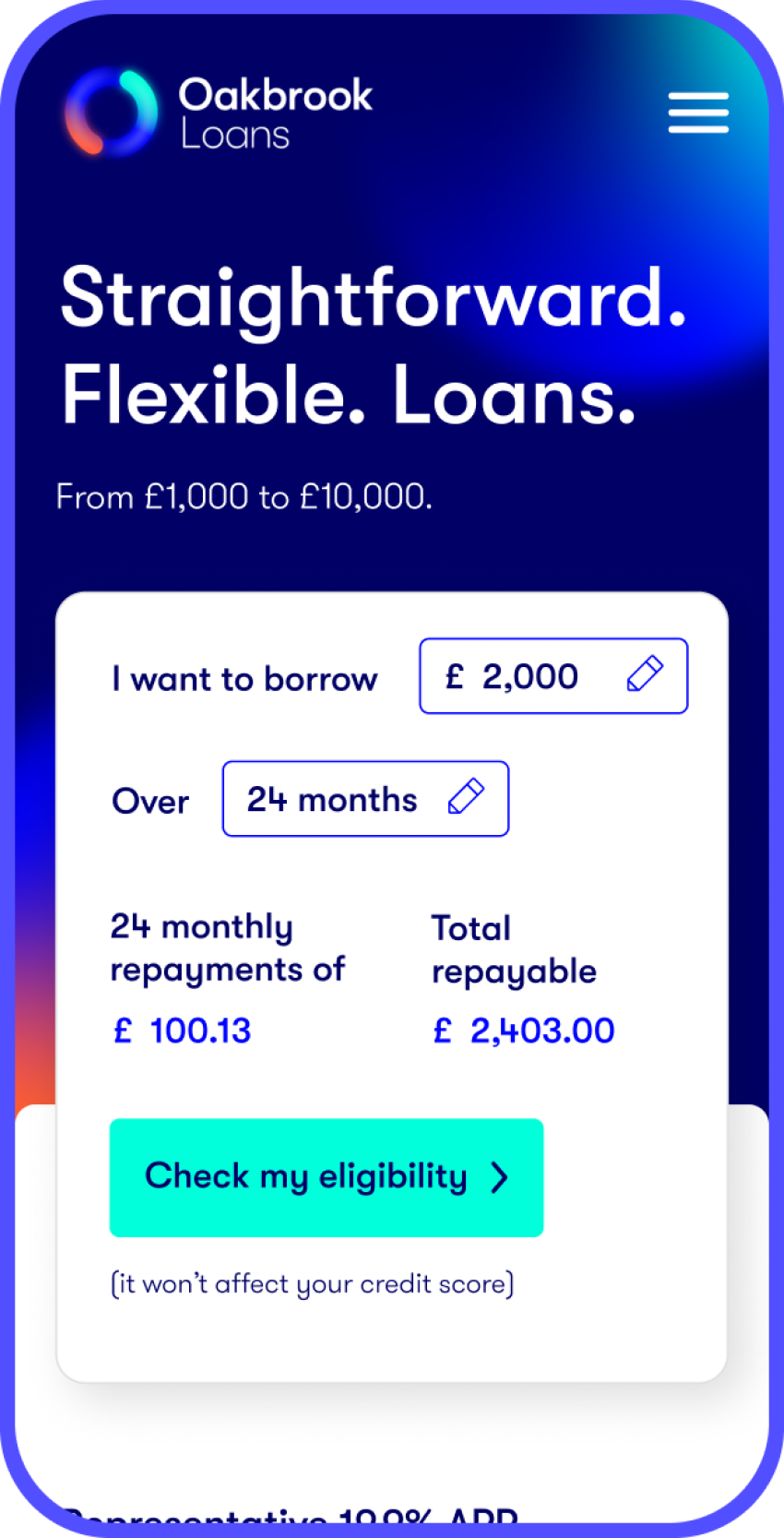

Our consumer product brands

Our Oakbrook Loans product serves the Prime and Near Prime customer market. With APR's ranging from 9.9% to 34.9% and loan amounts up to £15,000.

Packed full of amazing features, such as digital servicing via their online account, with Oakbrook Loans we’re putting our customers firmly in control of their borrowing.

- Simple online application to check eligibility

- Money received within a couple of hours from applying

- Omni channel account management (including bespoke digital online account)

- Repayment date changes

- Overpayments with no penalties

Finio Loans, offers an alternative choice for customers who may have found they're unable to access mainstream lending and offers loans up to £5,000 over 60 months.

It's packed full of great features, including a simple online application form where a customer can check their eligibility before they apply and has great digital servicing capabilities.

- Simple online application – applicants can check their eligibility before they apply

- Once accepted, customers will get their money in their bank within hours

- Customers can change their repayment date to one which suits them better

- Great digital servicing enabling customers to manage their loan how they want to – 24 hours a day, 365 days a year

- Overpayments with no penalties

After 8 amazing years we’ve recently let our Likely Loans product have a well-earned rest.

From September 2022 we changed our Likely Loans product to Finio Loans. This means we’re no longer offering Likely Loans for new customers. Instead, new customers are able to choose between applying for a Finio Loan or an Oakbrook Loan.

We still have a lot of customers with a Likely Loan, and we continue to support them with the very best service they’ve come to expect from us.

If you’re a Likely Loans customer who is looking for help and support, we have a dedicated page on our Finio Loans website for you. You can access this via the Finio Loans website or click here.

How we’re delivering our purpose though our products

Simple straightforward products

We’re all about creating simple, personalised, and affordable financial products. Products with flexible features to help customers manage their loans how they want to. Our customers get their money quickly once they've been accepted and can easily manage their loan online 24 hours a day 365 days a year, using their online account.

With Oakbrook, customers are able to overpay as much as they want as many times as they like with no penalties, choose a repayment date that suits them, and benefit from no fees.

Working in partnership with our customers

We work in partnership with our customers to make sure the loan they're applying for is right for them. How we're using Open Banking plays a big part in this as it enables us to make more personalised credit decisions based on an applicant’s most up to date financial information.

It's really important to us that our products have a positive impact on our customers financial wellbeing and that, for some of our customers, helps get them on a path to cheaper borrowing in the future. As a responsible lender, it goes without saying that all our products are underpinned by rigorous affordability assessments.

Digital servicing

When it comes to our customers managing their loan products we’ve invested heavily in our online account service. Customers have access to their loan account 24 hours a day, 7 days of the week and are able to benefit from a wide range of features within it. Changing their payment date, making their repayments, and updating their details are just some of the services available. They can even chat to us using our online chat service if they prefer not to call.

Our digital servicing capabilities help get us one step closer to our purpose of 'simplifying and personalising borrowing' and we continue to develop these services to create the very best customer experience in the loans market.